Weighted Average What Is It How Is It Calculated and Used

Weighted Average: What Is It, How Is It Calculated and Used?

What Is Weighted Average?

A weighted average is a calculation that considers the varying degrees of importance of numbers in a data set. Each number in the data set is multiplied by a predetermined weight before the final calculation is made. This method can be more accurate than a simple average where all numbers are assigned equal weight.

Key Takeaways:

– The weighted average considers the relative importance or frequency of factors in a data set.

– A weighted average is often more accurate than a simple average.

– In a weighted average, each data point value is multiplied by the assigned weight, then summed and divided by the number of data points.

– A weighted average improves data accuracy.

– Stock investors use a weighted average to track the cost basis of shares bought at different times.

What Is the Purpose of a Weighted Average?

In a simple average, all numbers are treated equally with equal weight. However, a weighted average assigns weights according to the predetermined importance of each data point.

A weighted average aims to equalize the frequency of values in a data set. For instance, a survey may have responses from all age groups, but the 18 to 34 age group may have fewer respondents relative to their share of the population. The survey team may weigh the results of the 18 to 34 age group to ensure proportional representation.

Weights in a data set may also be assigned for reasons other than frequency. For example, in a dance class, students may be graded on skill, attendance, and manners, with greater weight given to skill.

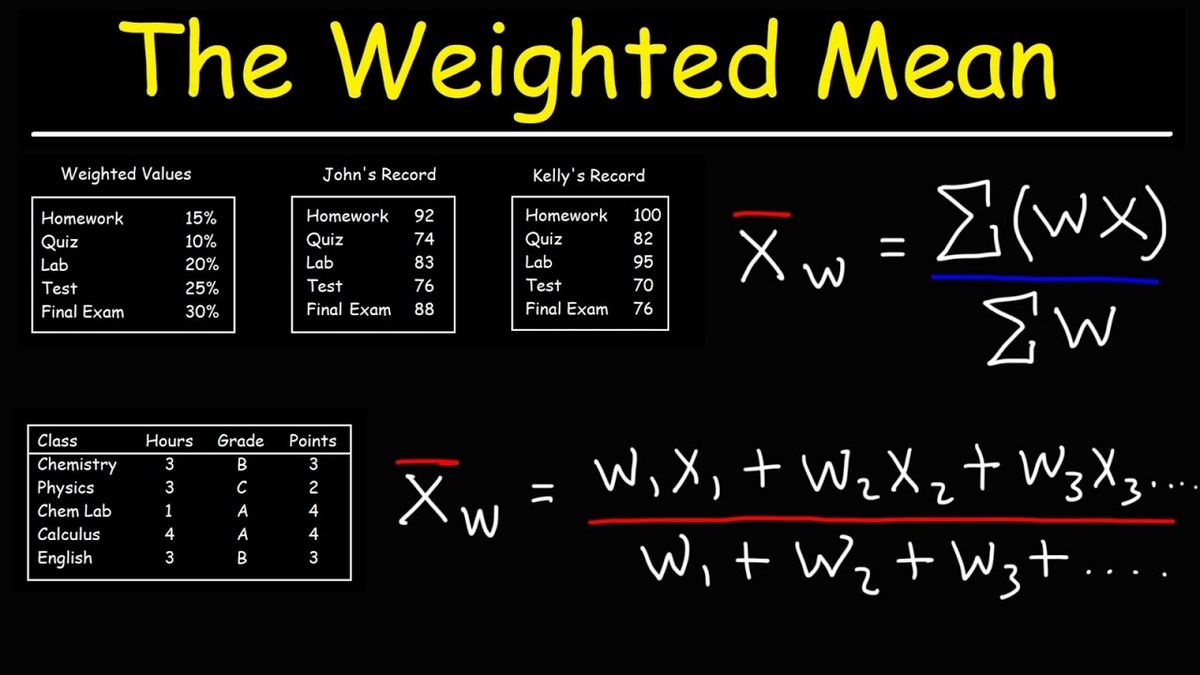

To calculate a weighted average, each data point value is multiplied by the assigned weight, then summed and divided by the number of data points. This provides a more descriptive average that reflects the relative importance of each observation and enhances data accuracy.

Weighting a Stock Portfolio

Investors often acquire shares of a stock over several years, making it challenging to track the cost basis and changes in value. To calculate the weighted average of the share price paid, the investor multiplies the number of shares acquired at each price by that price, adds the results, and then divides the total value by the total number of shares.

Examples of Weighted Averages

Weighted averages are used in various areas of finance, such as portfolio returns, inventory accounting, and valuation. When a fund holds multiple securities and is up 10% on the year, that 10% represents a weighted average of returns based on the value of each position in the fund.

In inventory accounting, the weighted average value of inventory accounts for fluctuations in commodity prices, while methods like LIFO or FIFO give more importance to time.

When evaluating companies for accurate share pricing, investors use the weighted average cost of capital (WACC), which is weighted based on the market value of debt and equity in a company’s capital structure.

How Does a Weighted Average Differ From a Simple Average?

A weighted average considers the relative contribution or weight of items being averaged, while a simple average does not. Thus, a weighted average assigns more value to items that occur more frequently.

Examples of Weighted Averages Used in Finance

Finance utilizes many weighted averages, including the volume-weighted average price (VWAP), weighted average cost of capital, and exponential moving averages (EMAs) used in charting. Portfolio weights and the LIFO and FIFO inventory methods also rely on weighted averages.

How Do You Calculate a Weighted Average?

To calculate a weighted average, multiply the relative proportion or percentage of each item by its value, then add the sums together. For example, if a portfolio consists of 55% stocks, 40% bonds, and 5% cash, multiply these weights by their annual performance to get the weighted average return.

The Bottom Line

Statistical measures, such as weighted averages, are crucial in investment decision-making. They help determine average share prices and portfolio returns, offering greater accuracy than simple averages. Calculate a weighted average by multiplying each number in the data set by its weight and summing the results.