Weighted Average Credit Rating WACR

Contents

Weighted Average Credit Rating (WACR)

What Is a Weighted Average Credit Rating?

The weighted average credit rating (WACR) relates to the rating of all bonds in a bond fund. This procedure provides investors with insight into a fund’s credit quality and overall risk. A lower weighted average credit rating indicates a riskier bond fund. The rating is designated in letter form, such as AAA, BBB, or CCC.

Key Takeaways

- A weighted average credit rating provides insight into a fund’s overall credit quality, designated as AAA, BBB, or CCC.

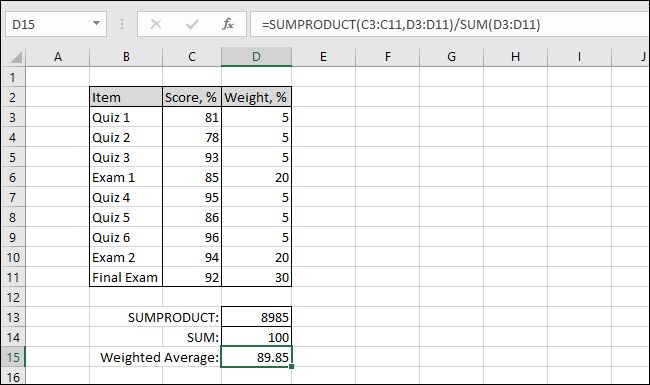

- The weighted-average credit rating is calculated by considering the proportion of each individual credit rating and noting it as a percentage of the entire portfolio.

- Some question weighted average credit ratings as they may cause confusion for investors who don’t understand the rating.

- Linear factors are used to determine a fund’s credit quality based on default probability.

How a Weighted Average Credit Rating Works

The calculation of a weighted average credit rating varies throughout the financial industry. In general, it takes into consideration the proportion of each credit rating and treats it as a percentage of the portfolio. By assigning individual rating weights and calculating the average credit rating.

A weighted average credit rating helps investors uncover the true credit quality of a bond fund.

Special Considerations

The weighted-average credit rating is not the only statistic that investors have access to when understanding a fund’s credit quality. Statistical reporting companies may integrate a linear factor into weighted average credit rating calculations. This methodology determines the weight of each rating level based on default probability.

By assigning a linear factor to each rating level, an average linear factor is determined based on the proportional credit ratings of the bonds in the portfolio. The weighted-average credit rating is then determined by its corresponding linear factor.

Criticism of Weighted Average Credit Ratings

This rating process has been disputed in the bond fund industry due to the potential for investor confusion. A weighted average rating methodology considers all potential rating classifications a fund can invest in, which can lead to confusion when there are no bonds in a specific weighted average rating category.

Example of a Weighted Average Credit Rating (WACR)

For example, a bond with 25% value in AAA, 25% in BBB, and 50% in CCC could have an average credit rating of B+, which falls between BBB and CCC. However, this may not provide an accurate representation to investors if the fund does not hold any B+ bonds. To address this, most bond funds provide a scale with weightings by credit rating in their marketing materials.

The Vanguard Long-Term Corporate Bond ETF is a large bond fund with over $6 billion in assets. It does not provide a weighted average credit rating but includes a scale showing its credit quality dispersion as of December 31, 2020.

| U.S. Govt. | 0.3% |

| Aaa | 2.7% |

| Aa | 9.1% |

| A | 37.4% |

| Baa | 50.5% |

| < Baa | 0.0% |

| Total | 100.0% |