Warehouse Receipt What it is How it Works

Contents

Warehouse Receipt: What it is, How it Works

What Is a Warehouse Receipt?

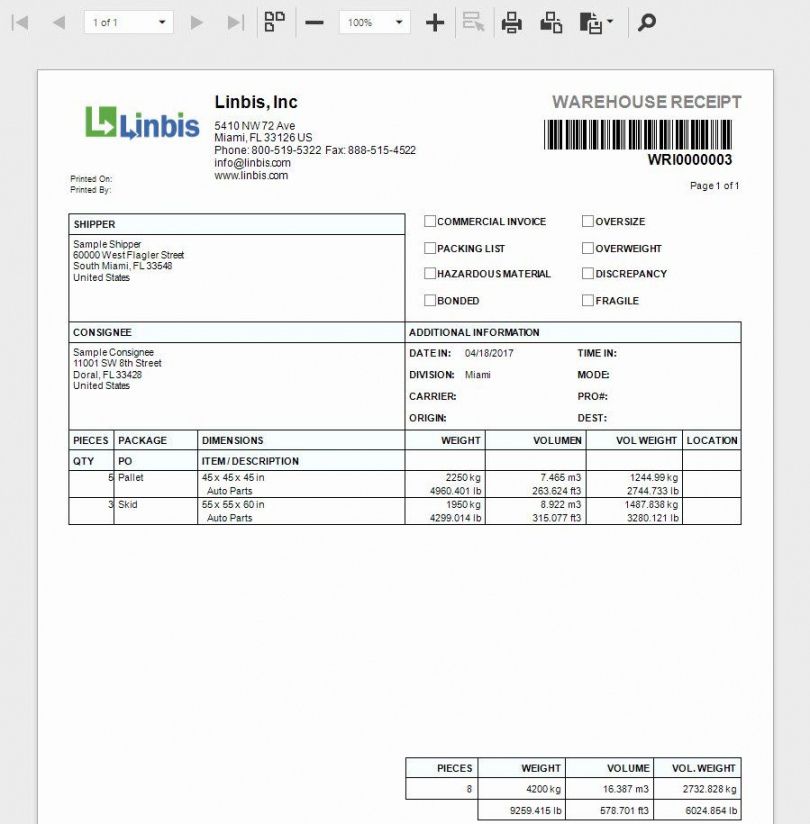

A warehouse receipt is documentation used in futures markets to guarantee the quantity and quality of a commodity stored in an approved facility. Warehouse receipts serve as proof of the commodity’s presence in the warehouse and verification of the necessary documentation. They are also important in the warehouse financing process to verify the quality of collateralized inventory.

Commodities must meet specific quality standards to be traded as futures contracts, and warehouse receipts verify the fulfillment of these requirements.

Key Takeaways

- A warehouse receipt guarantees the quantity and quality of a stored commodity in futures markets.

- Exchange-approved warehouses provide secure storage and inventory management for the physical commodity.

- The warehouse receipt provides the exchange with documentation of available goods for transfer to a buyer.

Understanding a Warehouse Receipt

Warehouse receipts are part of the operational business processing in futures contracts for physical delivery. Futures contracts involve buying or selling commodities or securities at a predetermined price on a future date. These contracts derive their value from the underlying security or commodity. Commodity futures include corn, wheat, oil, gold, and silver, among others. They are standardized with set quantities and specific delivery dates throughout the year.

Quality standards must be met for commodities to be delivered and fulfill futures contracts. Warehouse receipts play a role in managing inventory and delivering the underlying commodities. Instead of physically delivering commodities, warehouse receipts can also settle futures contracts. In the case of precious metals, warehouse receipts may be referred to as vault receipts.

Commodities for Physical Delivery

Futures contracts are widely used by companies involved in manufacturing and transportation of various goods. Popular futures exchanges include the Chicago Mercantile Exchange (CME), Chicago Board of Trade (CBOT), New York Mercantile Exchange (NYMEX), and the New York Board of Trade (NYBOT). Buyers and sellers use futures exchanges to hedge against price volatility and profit from arbitrage opportunities.

Most trades on futures exchanges are made by commercial traders who buy or sell commodities for physical delivery. These commodities are used to produce and manufacture goods that contribute to the gross domestic product (GDP) of the U.S. economy.

Commodity futures contracts differ from options on stocks. Options contracts give holders the right to buy or sell underlying stocks at preset prices. Stocks and other underlying securities for options can be electronically bought and sold with electronic settlement, while futures contracts require physical inventory tracking. To deliver commodities as a result of futures contracts, specific quality standards must be met.

Certificated Stock

Physical inventory tracking involves important procedures for commodity producers. To write contracts on their commodity inventory, producers must be licensed and registered. Physical inventory is certified through inspection and authentication, resulting in certificated stock approval. Certificated stock is used for writing contracts on inventory in the futures market.

Warehouse Receipts

Each futures exchange has specific delivery and storage requirements that must be met. For example, at the CME, only exchange-approved warehouses can deliver against futures contracts.

Exchange-approved warehouses provide secure storage locations for physical commodities and offer inventory management services to the futures exchange. These warehouses ensure that delivered commodities meet strict specifications, including proper certifications. Copper and gold, for example, have specific weight and quality requirements that must be met before a warehouse can accept a shipment.

Warehouse receipts are an operational step when using a physical commodity as backing for a futures contract. They provide the exchange with documentation to verify the availability and readiness of authorized goods for transfer to a buyer. The entity selling their inventory writes a futures contract at a specified price.

Short commodity futures contracts require warehouse receipts. The entity taking the long position is assured by the warehouse receipt. At contract expiration, the entity with the long position receives the commodity inventory at the specified price.

If a buyer doesn’t want to take delivery of the entire commodity, they can ship a partial order to their desired location and hold the remaining portion in the warehouse. The warehouse receipt serves as proof of ownership for the commodity stored in the exchange-approved warehouse.