Risk Lover What it is How it Works Dealing With Them

Contents

Risk Lover: What it is, How it Works, Dealing With Them

What Is a Risk Lover?

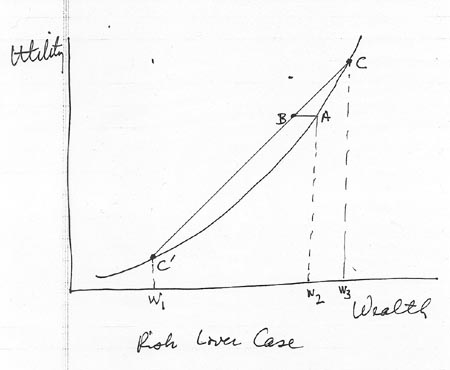

A risk lover is an investor willing to take on additional risk for an investment with a relatively low expected return in exchange.

Key Takeaways

- Risk lovers gravitate towards investments with extremely high potential payouts despite higher potential for loss.

- Risk lovers consider investments that valuation methods typically filter out.

- Risk lovers help de-risk the market for more conservative investors.

Understanding Risk Lovers

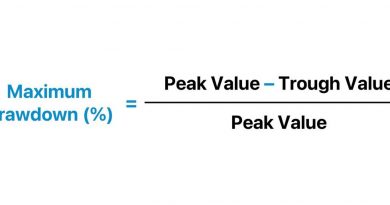

Risk lovers seek out extremely risky investments with excess kurtosis in return distribution. This means there is a frequent instance of high standard deviation outcomes.

A risk lover is the opposite of a risk-averse investor who only takes on increased risks if they come with a potential for higher returns. Risk lovers don’t need to see a pattern of high returns to take on a risky investment. This approach can improve portfolio returns, especially with experience in filtering companies for signs or signals. However, the probability of long-term success is lower due to increased uncertainty from excess risks.

There is always a risk/return tradeoff in investing. Lower-risk investments have lower returns, while higher-risk investments have higher potential returns. The market compensates for additional risk.

But sometimes, this compensation is not fair based on valuation techniques. It’s ultimately up to the investor whether the skew towards downside risk is worth the potential upside returns.

Risk lovers play an important role in the market by taking fliers on less attractive investments. Since most investors are conservative, risk needs to be shaved off to align with their preferences. Pooling and derivatives are often used for this purpose.

Ideally, well-capitalized entities use only a small portion of their portfolio for risk-skewed investments. If an entire portfolio or a significant portion is dedicated to such investments, bad luck or poor timing can lead to significant losses.

Dealing With Risk Lovers Professionally

Risk lovers often resist conservative portfolio management techniques when managing their own investments. However, when working with a financial advisor, it can be challenging to deal with. Advisors may need to address cognitive or emotional bias before engaging with the client’s portfolio.

Risk loving should be targeted at a portion of available capital instead of going all in. Financial advisors need to find a valuation method that satisfies the client’s higher risk tolerance while staying within acceptable limits of risk-reward tradeoff.