Mini-Perm Definition Uses Vs Construction Loan

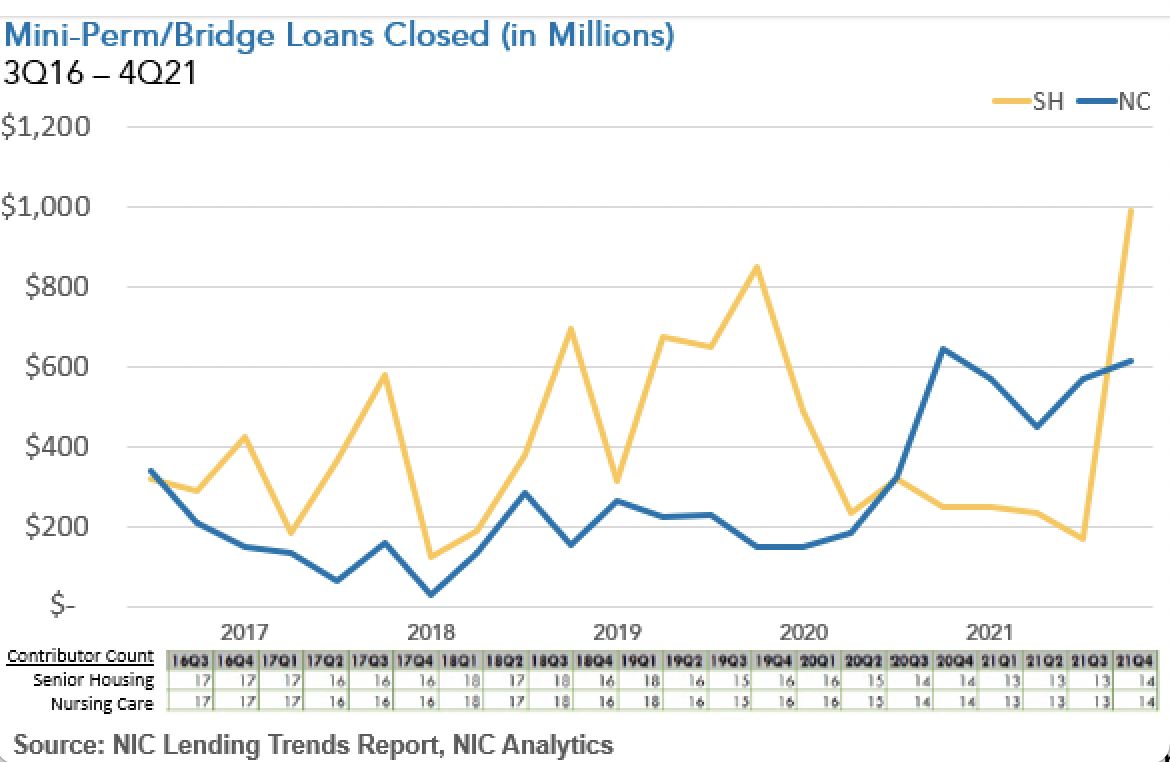

Mini-perm is short-term real estate financing used to pay off income-producing construction or commercial properties, typically in three to five years.

Key takeaways:

– Mini-perm financing is used to pay off construction projects or commercial properties before they become profitable.

– This financing typically covers periods of three to five years or less.

– It is also used for investment property acquisition.

Mini-perm financing is used by developers until a project is completed and can start generating income. It serves as a temporary solution until long-term or permanent financing is secured. It can also be used for investment property acquisition.

Implementing mini-perm financing can be useful for new commercial properties that haven’t yet generated revenue. It covers the interim period until the property starts generating income and establishes a track record of performance.

Retail properties, like shopping malls and restaurant sites, rely on regular patronage to generate revenue. If a new property doesn’t attract enough tenants or customers, it may not generate the expected income.

Industrial and office complexes face similar challenges if they don’t have enough tenants to fill the property.

Mini-perm financing is being used for alternative purposes such as developing land, buying underperforming income property and leasing it up, or taking advantage of distressed debt and non-performing notes.

One potential risk of mini-perm financing is that the cost of development could exceed the budget, reducing the developer’s ability to generate a profit and repay lenders.

Mini-perm financing differs from other short-term lending options, like construction loans or construction-to-permanent loans. Construction loans cover the costs of building and can lead to long-term financing, but they have higher interest rates due to the associated risks.