What Double Taxation Is and How It Works

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

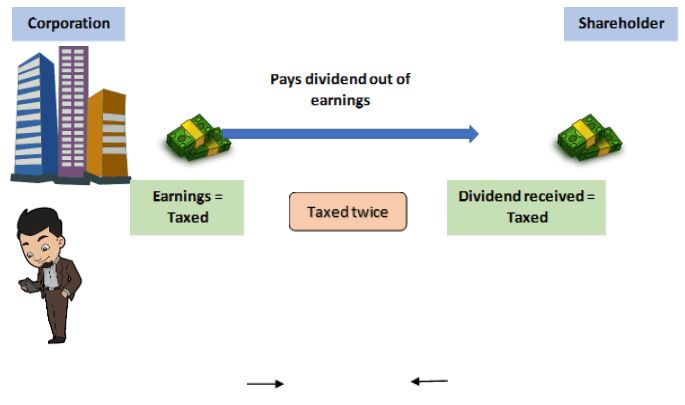

Double taxation is a tax principle where taxes are levied twice on the same income source. It can happen when income is taxed at both the corporate and personal levels, or in international trade or investment when income is taxed in two different countries.

Key Takeaways:

– Double taxation refers to income tax paid twice on the same source.

– This can happen when income is taxed at both the corporate and personal levels, such as with stock dividends.

– It can also happen when the same income is taxed by two different countries.

– Critics argue that dividend double taxation is unfair. Advocates claim it prevents wealthy stockholders from avoiding income tax.

Double taxation often occurs because corporations are separate legal entities from their shareholders. They pay taxes on their earnings, just like individuals. When corporations pay dividends to shareholders, these dividend payments incur income-tax liabilities for the shareholders, even though the earnings were already taxed at the corporate level.

Double taxation is often an unintended consequence of tax legislation and is generally seen as negative. Most tax systems attempt to integrate income earned by corporations and individuals, using different tax rates and credits, to ultimately tax them at the same rate. For example, qualified dividends in the U.S. can have advantaged tax treatment with rates of 0%, 15%, or 20%, based on the individual’s tax bracket. The corporate tax rate is currently 21% (2022).

The concept of double taxation on dividends has sparked significant debate. Some argue that it is unfair to tax shareholders since the funds were already taxed at the corporate level. Others believe this tax structure is justified. Proponents argue that without dividend taxes, wealthy individuals could avoid paying taxes on their personal income. They also note that dividend payments are voluntary actions by companies.

Certain investments, like master limited partnerships, avoid double taxation through a flow-through or pass-through structure.

International businesses often face double taxation issues. Income may be taxed in the country where it is earned and then again when it is repatriated to the business’ home country. To address this, countries have signed treaties to avoid double taxation and promote trade.

If individuals work or perform services in different states, they may need to file tax returns in multiple states. However, most states have provisions in their tax codes to help individuals avoid double taxation. This can involve reciprocity agreements between states or providing taxpayers with credits for taxes paid out-of-state.

The 183-day rule is a threshold used by some states to determine tax residency. If an individual spends 183 days or more in a state, they may be considered a full-year resident for tax purposes.

Several states, including Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming, do not levy state income taxes. However, if residents of these states work or perform services in other states, their income may still be taxed by those states.

In summary, double taxation occurs when taxes are levied twice on the same source of income. This can happen with dividends being taxed, and corporations and individuals paying taxes on annual earnings. Double taxation can also arise when income is taxed in multiple countries. To mitigate potential double taxation, many countries have established tax treaties to avoid excessive taxation and promote trade.